If you’ve obtained an effective windfall or keeps enough coupons, you might want to shell out their home loan out-of very early. money loans in Iliff Colorado This is how to determine when it is most effective for you.

If you have been squirrelling aside their pennies, or features recently obtained a windfall or heredity, chances are expenses your mortgage of very early might’ve entered your own head.

You will find benefits and drawbacks in order to this, but not, it is therefore important that you shop around before making a decision in order to pay their financial away from. Right here, we glance at the significant benefits and drawbacks out-of paying your own mortgage through to the financing term is right up.

Advantage: end up being financial obligation-100 % free sooner

If the home loan is your just debt following investing it off is the best treatment for end up being obligations-free for life.

There might be can cost you a part of paying your mortgage out of early, therefore even although you have sufficient to pay they completely, communicate with a home loan adviser to make sure you are able to cover they.

Your own mortgage is the large debt, but when you have bank card expenses or auto loan after that you may benefit from expenses those out-of very first.

Mortgage loans enjoys all the way down rates than other credit lines particularly store cards, credit cards and you may auto fund. So given that sum of their mortgage may suffer eyes-wateringly grand, the interest on your own quicker finance and you may borrowing preparations will cost your significantly more.

It might match your private condition to pay off people quicker expense, such as credit cards, due to the fact an issue of consideration. You can then contemplate utilising the additional monthly cash flow out of removing these expense on the offsetting your financial and still pay it back sooner than you expected.

Advantage: no more monthly premiums

Paying the mortgage will provide you with freedom of money: no monthly obligations mode you’ll have multiple hundred lbs even more in your bank account every month.

That it extra money leaves we using some off possibilities. Specific like to take advantage of the other cash because of the providing so much more vacations and you can enjoying luxury circumstances. Someone else make chance to reduce their earnings to restore a better performs-lifetime harmony because they not any longer possess a mortgage connection.

Disadvantage: you are able to early fees charge

Sometimes, it’s still worthy of expenses so it percentage if it will probably save you attention costs fundamentally. Although not, you should look at the price of it fee, especially if you might be drawing near to the termination of their financial title anyhow.

Advantage: eliminate full financing rates

Spending your mortgage of early, particularly if you’re not within the last long time of your financing title, decreases the full mortgage costs.

The reason being you can save a good deal on the notice that renders right up part of your commission agreement. Spending their mortgage away from early function you’ll not have to pay focus with the days you no longer need to blow, protecting a lot of money along with conclude the mortgage age before.

Disadvantage: missed savings attention otherwise pension advantages

Repaying a mortgage may not be the most suitable choice to possess you in the event the discounts interest levels be much more versus appeal your pay in your mortgage.

Also, if you don’t have a soft retirement cooking pot saved for the old age, it is worth considering and make a giant share on the pension plan to take advantageous asset of the income tax gurus this could provide.

Consider right up these types of choices is state-of-the-art and you can may vary with regards to the monetary markets. Be sure to located professional monetary guidance before deciding if to expend your bank account or pay your home loan.

Choices for settling your home loan early

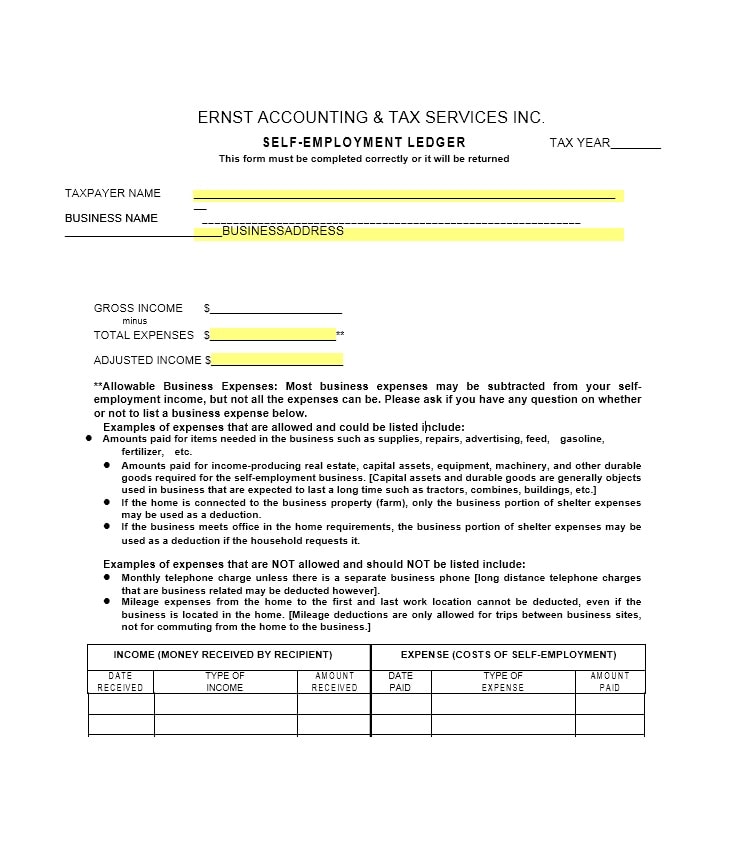

There’s two a means to shell out their mortgage out of early: spend a lump sum in full or improve monthly premiums.

Overpaying the monthly obligations will get match you if the house have an increase in your normal monthly income, eg providing a publicity where you work. Furthermore a good way to benefit from low interest rates: repaying up to you could while you are rates are lower form you will see a reduced amount of the mortgage remaining to expend regarding when rates is highest.

Remortgage

If you find yourself out from the fixed label age the financial, shop around to obtain an alternative price. Enjoy the facts you currently paid off some of your mortgage, and this reveals greatest rates because of a reduced mortgage-to-worthy of (LTV) proportion.

Switch to an offset mortgage

When you have a good amount of spare funding monthly, otherwise can afford to hop out a massive lump sum for the financial, imagine an offset mortgage.

Which hyperlinks a family savings toward financial. Money into your checking account can be used to help you offset their financial prices, saving you appeal and you can assisting to repay it before. Doing so can also help one prevent very early payment costs.

Shell out a lump sum payment

For those who have sufficient in your discounts to pay all of your financial, together with very early installment costs, believe paying the entire financial off all at once.

Boost monthly premiums

Check your latest financing arrangement to see if overpayments is acceptance, or if you normally negotiate a new month-to-month profile. Some company tend to charges for it while most other loan providers enables overpayments up to a certain amount yearly instead of a penalty.

Talk to home financing adviser to find out more

As you can tell, spending their financial away from very early will save you thousands of pounds subsequently. Although not, you’ll find reasons why you should remain expenses their mortgage and you can as an alternative, expenses your offers one other way.

It’s a complicated situation so you can browse, so it is a good idea to seek expert advice just before moving submit. Book a consultation with our team to determine just what solutions match your activities.

Important information

There ount you pay is dependent on your circumstances. The fee is perfectly up to step 1% but an everyday commission is 0.3% of your own loan amount.

Subscribe our monthly newsletter

Sit up-to-date aided by the latest mortgage development and you may homebuying tips that have all of our monthly publication. Jam-loaded with helpful tips and you may information, you’ll usually see what’s happening in the industry and just how they you’ll apply at you.

Whether you’re a first and initial time buyer or preparing to remortgage, the audience is here for your requirements which have of good use tools, stuff and information produced directly to the email.

Be the first to post a comment.